Are you thinking about the cost of living in Toronto before your arrival?

That is one of the questions asked by many people who would like to relocate to this great city in Ontario.

Toronto has a great, lively lifestyle, but living there can be expensive for those who are not prepared yet.

Since the purchasing power for many people is lower than before, living cost in Toronto became more important than ever.

Understanding these costs is key to managing your finances in Toronto.

You will learn how to:

1. Find out the average housing and rental prices in Toronto.

2. Learn about typical utility and transportation costs.

3. Explore food, healthcare, and entertainment expenses

How Much Does Housing Cost in Toronto?

When it comes to the cost of living in Toronto, one must first consider the cost of housing.

The housing market in Toronto is highly dynamic and varied.

Let’s go a little deeper into the details of rental prices, home buying, and other housing costs.

Average Rent for Apartments by Neighborhood in Toronto

Rental prices vary around Toronto.

In downtown Toronto, you can expect to pay an average of about $2,300 per month for a one-bedroom apartment.

Head to North York and that same apartment may cost you about $1,800.

Scarborough is where you can find more affordable options, starting at roughly $1,500.

These rental expenses may increase if you are looking for pet friendly rental options for yourself as they are a little higher than average prices.

These differences show how imperative it is to select the correct neighborhood that fits your budget.

If you would like to save some dollars on the rent, we would recommend that you check room rentals for students in Toronto.

| Area in Toronto | Minimum Room Rental Price (CAD) | Maximum Room Rental Price (CAD) |

|---|---|---|

| Downtown Toronto | $2,400 | $2,800 |

| North York | $2,200 | $2,600 |

| Scarborough | $1,900 | $2,300 |

| Etobicoke | $2,000 | $2,400 |

| Midtown Toronto | $2,500 | $3,000 |

| The Beaches | $2,300 | $2,700 |

| Liberty Village | $2,600 | $3,100 |

| East York | $2,100 | $2,500 |

| Yorkville | $2,800 | $3,500 |

| Mississauga (near Toronto) | $2,000 | $2,600 |

What Are the Typical Utility Costs in Toronto?

Utility costs in Toronto are somewhat high, and understanding this is important for effective budgeting.

Whether you’re new or an old resident, knowing what to expect puts you in a better place to manage your monthly expenditure.

Let’s break these costs down for a clear picture.

Breakdown of Monthly Utility Bills

Utility bills in Toronto vary but again are in a similar range: $100 to $150 a month for a typical apartment would cover both electricity and heating.

You might add an additional $30 to $50 to this for your water bills. These do change throughout the year because of seasons and other factors involved with personal use.

Internet and Garbage Collection Fees

Internet services in Toronto can cost anywhere from $50 to $100 a month, depending on the speed and the provider.

Garbage collection is usually covered under property taxes for homeowners.

For renters, it may be included in the rent, but that would have to be discussed with the landlord.

Eco-Friendly Energy Options

Toronto provides many eco-friendly energy options that could save money and the environment.

Think about using energy-efficient appliances and LED lighting.

Solar panels are also gaining momentum and will lower long-term electricity costs.

These options not only reduce bills but also make for a greener city.

How Much Do Transportation Expenses Add Up To?

When thinking about the rising cost of living in Toronto, transportation is a big factor.

Public transit within Toronto, which is known as the TTC, is pretty affordable.

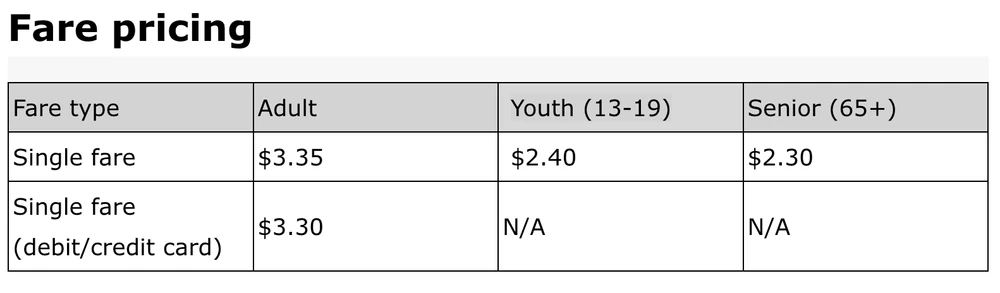

Costs of Using the TTC

The TTC is Toronto’s primary public transit option.

A single adult fare will run $3.35 and Monthly passes cost $156.

Source: TTC Fares

Thus, with these rates, the more frequent commuters would find using the TTC an economical choice for daily commutes.

The TTC includes buses, subways, and streetcars, which blanket across the city.

It is worth noting that especially for newcomers to Toronto, learning the TTC routes would make it easier to move around and save money.

Owning a Private Vehicle in Toronto

Getting a car in Toronto might be expensive.

You will also have to consider insurance, estimated at $1,500 annually.

Gas is about $1.50 a liter in Toronto.

Let’s get one thing straight: parking fees add up fast, with an approximate monthly cost of $200 downtown.

Vehicle maintenance and repairs are extra costs.

For many, the convenience of a car comes at a considerable cost.

Alternative Transportation Options

Alternative transportation is on the rise in Toronto, Canada.

Ride-sharing services like Uber and Lyft offer flexible travel options.

Bike-sharing programs are also an option, with annual memberships available for about $99.

Carpooling with coworkers can help to defray the cost of a commute.

These options offer flexibility and are cheaper than car ownership.

Understanding these options can drastically simplify your expenses for transportation.

How Much Do Food and Groceries Cost in Toronto?

Understanding how much food and groceries cost in Toronto is relevant to anyone who is living in or moving to the city.

Toronto has a lively food scene, with everything from affordable groceries to all varieties of restaurants available.

Typical Grocery Prices of Essentials

Grocery prices can vary in Toronto, but it’s good to have an idea of the average costs for budgeting.

A liter of milk costs about $2.50, while a loaf of bread is about $3.00. You might spend $3.50 for a dozen eggs and $4.00 for a kilogram of rice. Fruits and vegetables, of course, change with the seasons, but apples cost roughly $3.00 per kilogram.

Shopping around will, no doubt, get the best deals for your items because many supermarkets and local shops are found in Toronto.

Dining out in Toronto’s various foods

In Toronto, fresh groceries can be found at a wide variety of supermarkets and farmers’ markets.

The supermarket chains like Loblaws and Metro are very well-liked for their selection of goods.

Farmers markets are spread all over the city and provide fresh produce. They are a good place to support local farmers and get a taste of what is fresh this season.

Be it the convenience of supermarkets or the appeal of farmers’ markets, Toronto has a choice to fit every shopper’s taste.

What Are the Healthcare Expenses in Toronto?

For anyone living in Toronto, it is crucial to understand the expenditure of healthcare here.

In Toronto, both public and private health services come with their costs, hugely affecting your cost of living.

Let’s delve into the nitty-gritty of what you would most likely incur in healthcare expenditures in this vibrant metropolis.

Overview of OHIP and Services Covered

The Ontario Health Insurance Plan (OHIP) is a public health insurance program that covers many essential services.

If you are eligible, OHIP will cover doctor visits, hospital stays, and some medical procedures.

However, it does not cover everything.

For instance, dental care, eye exams for adults, and prescription drugs are not included.

Knowing what OHIP covers helps you plan for any additional healthcare expenses.

Out-of-Pocket Healthcare Costs

Even with OHIP, you might find yourself paying for some medical services.

Out-of-pocket costs can include dental visits, vision care, and certain prescription medications.

These expenses can add up, so it’s wise to budget for them.

For example, a routine dental cleaning could cost around $150.

Understanding these costs helps you manage your healthcare budget effectively.

Private Insurance Options

To cover services not included in OHIP, many people opt for private insurance.

Private health insurance can help pay for dental, vision, and prescription drugs.

Plans vary widely, so it’s essential to compare options.

Some employers offer health benefits, which can reduce your out-of-pocket expenses.

Choosing the right insurance plan can provide peace of mind and financial security.

How Much Do Education and Childcare Cost in Toronto?

Considering the cost of living in Toronto, education and child care play major roles.

Families and students are supposed to understand these costs to have proper planning for budgets.

Now, let’s review some information on childcare services and the cost of school and international student tuition in Toronto.

Child Care Services and Costs

In Toronto, the cost of child care could be high.

For instance, daycare would averagely cost around $1,200 to $2,000 per month.

Parents often look for government subsidies to help them balance these costs.

For families, the scale between quality and affordability is quite delicate to balance.

Public and Private School Tuition

Public schools in Toronto are publicly subsidized and hence free for all residents to attend.

Private schools are privately financed and charge tuition that can range from $6,000 to $30,000 annually.

Each school has a specific curriculum, and most parents choose a school based on their priorities regarding education.

Expenses for International Students

International students in Toronto face higher tuition fees.

They typically pay between $15,000 and $60,000 per year, depending on the program.

Besides tuition, students must budget for living expenses, supplies, and other essentials to ensure a comfortable stay in the city.

What Are the Entertainment and Leisure Costs in Toronto?

Toronto is a city full of life, offering a rich tapestry of entertainment and leisure activities.

Knowing the cost of such activities helps in budgeting appropriately.

Let’s delve deep into how one can get around Toronto without spending so much money.

Prices of Movies, Gym, and Festivals

When in Toronto, one movie ticket goes for approximately 15 dollars.

For fitness-conscious individuals, gym memberships can be from 50 to 100 dollars per month.

Events, such as the Toronto International Film Festival, run the gamut in price from free events to ticketed events. These can certainly add up but are well worth it for the experience.

Free or Low-Cost Community Events

Numerous events happen around Toronto that are either free or low-cost. From street festivals to art exhibits, there is always something happening.

These events are a great way to enjoy the vibrant culture of the city without having to spend much.

Checking local listings can help you find these hidden gems.

Seasonal Attractions in Toronto

Toronto’s seasonal attractions give a wide range of options.

Skating at Nathan Phillips Square is one popular and relatively affordable option in winter.

In summer, outdoor concerts and days at the beach are in order.

These are not just entertaining but also very representative of Toronto’s character.

A little planning will go a long way in being able to enjoy these seasonal treats.

How Much Do Clothing and Personal Care Cost in Toronto?

Living in Toronto is quite expensive, and clothing and personal care are no exceptions.

Knowing these costs will be helpful for budgeting and enjoying life in this great city.

Average Price of Clothing in Toronto

Clothing prices in Toronto can vary greatly.

You can find more reasonably priced options at fast-fashion stores like H&M and Zara, where you can get a T-shirt for about $20 and jeans for around $50.

For those who like their luxury, Yorkville stores can have prices for a single item top hundreds of dollars easily.

Costs for Grooming and Wellness Services

Grooming and wellness services can add up pretty fast in Toronto.

A basic haircut at a local salon could cost about $30 to $50, while a visit to a high-end salon downtown could range from $80 to $150.

Spa services, like massages or facials, range from $100 per treatment, depending on the treatments desired for relaxation and rejuvenation.

Activity and Personal Care Options

Staying fit in Toronto can be affordable yet expensive, depending on individual preferences.

A monthly membership to a chain like GoodLife Fitness costs approximately $60.

If you enjoy boutique fitness classes, such as yoga or pilates, then you can expect to pay around $20 to $30 for every class.

In addition, personal care products-skin care and cosmetics are also widely available, with their prices varying greatly depending on the brand and quality.

What Miscellaneous Expenses Should You Consider in Toronto?

Living in Toronto is great, but you have to consider all your possible expenses.

Other costs can catch you off guard if you are not well prepared.

Let’s look at some of these costs to help you plan better.

Telecommunications and Streaming Services

Staying connected in Toronto is expensive.

The cost of a monthly internet plan ranges from CAD 50 to CAD 100, depending on the speed and service provider.

Mobile phone plans generally begin at CAD 40 for basic packages.

Streaming services, such as Netflix or Disney+, will add CAD 10 to CAD 20 to your monthly bills.

It pays to shop around for the best deals from providers.

You may save some money by bundling services.

Household Supplies and Emergency Repairs

Household supplies can be costly over some time.

The basic cleaning products, toiletries, and kitchen essentials may cost about CAD 100 per month.

Repairs can be quite unexpected and costly.

For example, some appliance breaking or a leak in the faucet might cost several hundred dollars.

It will be wise to keep small amounts of money aside with you for such surprises.

Regular maintenance can avoid further damage.

Pet Care and Other Unexpected Costs

And if you have pets then their care is another head of expense.

Food for them, grooming, veterinary visits, etc., alone may cost between CAD 100 to CAD 200 per month.

And the costs of unexpected vet bills are even higher.

Consider getting pet insurance to help with these costs.

Aside from pet care, there are other unexpected expenses, such as gifts or social outings.

Being prepared for them can help keep your budget on track.

Final Thoughts About Cost of Living in Toronto

Living in Toronto can be expensive, but at least it allows you to plan well if you know how much things cost.

We covered housing, utilities, transport, food, healthcare, education, and leisure.

Each area has unique expenses and options. Toronto offers diverse choices, from eco-friendly utilities to vibrant dining scenes.

Knowing these costs helps you budget wisely. Whether you’re renting, commuting, or enjoying local events, being informed makes a difference.

Toronto is vibrant and full of life, but it requires smart financial planning.

Keep these insights in mind as you navigate this dynamic city.

0 Comments